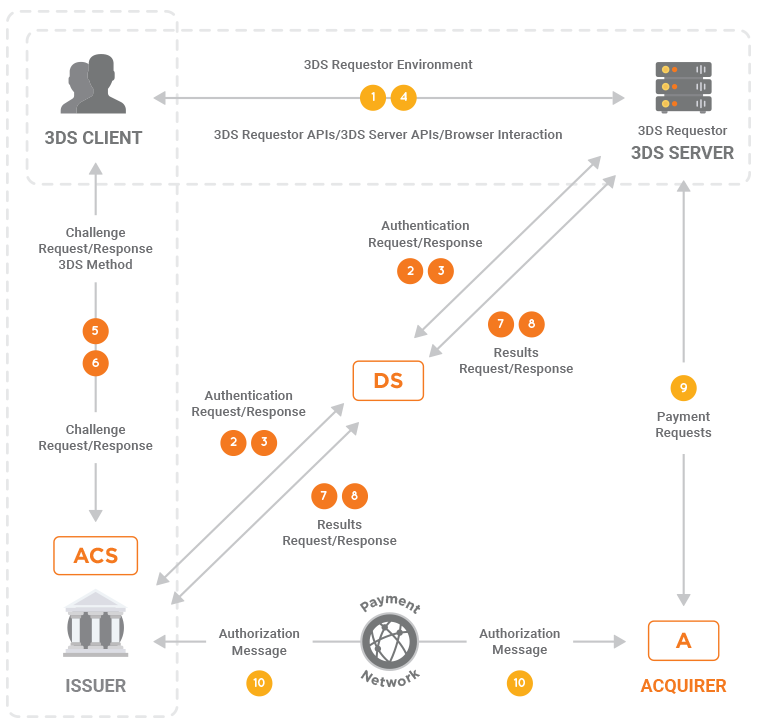

To cater for the needs of local transaction processing, Infinitium developed the 3DS-compliant Infinitium Directory Server (DS). Through this DS, Infinitium can provide aspiring local payment networks who wish to offer the connectivity and ability that 3-D Secure offers for their users to perform online transactions safely and conveniently.

Infinitium DS is developed based on EMV 3DS 2.2 protocol specification, and will continue to be updated as the version progresses. Infinitium’s Full DS Suite Applications comes with a Test Suite, a module for Digital Certificates Handling, a module to configure Custom Authentication Value (AV) Checksum, and the provision of On-behalf AV Validation feature for Issuers.

3-D Secure Program Professional Services

Having a DS is only a part of the work done to set up a local 3DS program. A 3DS Program encompasses the definition of the Rules & Regulations for the program, the onboarding of the participants and the testing of the 3DS components used by these participants, and the configuration of DS to the specific needs of the local environment. Infinitium possesses the expertise and experience in managing a 3DS Program and executing the operational aspects of running a DS.

The 3DS Program Professional Services team will be able to assist aspiring local payment networks if they wish to adopt EMV 3DS as their Card-Not-Present (CNP) authentication standards. Over a series of workshops, Infinitium will equip the local payment network to:

- Map out the program rules

- Determine the gaps

- Establish the onboarding process

- Assist in pilot implementations

- Translate the rules into configuration & parameters on the DS

- Customize DS to meet the local requirements

- Define the Test Plans on the Test Suites