Security & Convenience with Infinitium Token Gateway

Infinitium Token Gateway is compliant with PCI DSS and EMVCo Payment Tokenisation Standard, therefore Merchants can be assured that their customers’ payment data is protected in compliance with industry regulation. With tokenised payments, Merchants can now offer convenient payment experience to consumers with ‘Save Card’ feature, in which consumers do not need to re-enter their PAN in subsequent purchases. On the Merchant’s end, sensitive card details can be stored safely outside the Merchant’s system, thereby reducing PCI DSS scope.

To manage multi-channel payment acceptance by Merchants, Infinitium Token Gateway supports mass card registration and mass payment with token via Secure Batch File. This allows Merchants to securely register, authorise, charge and re-use a customer’s payment details across various channels without directly accessing the actual card data. With the ability to support multiple token formats and API, Infinitium Token Gateway enables Merchants to offer consumers their payment channel of choice without risking exposure of card data.

Further, tokenisation enables Merchants and Acquirers to manage digital payment lifecycle more effectively and securely. As one PAN can be digitised into several tokens based on the end user’s payment devices and channels, these tokens are entirely autonomous and can be suspended for a particular usage or device without impacting any other tokens in use.

Additionally, it enables the customer’s payment details to be instantly refreshed when a card is lost, stolen or expires, without having them to log on to their accounts to update the details.

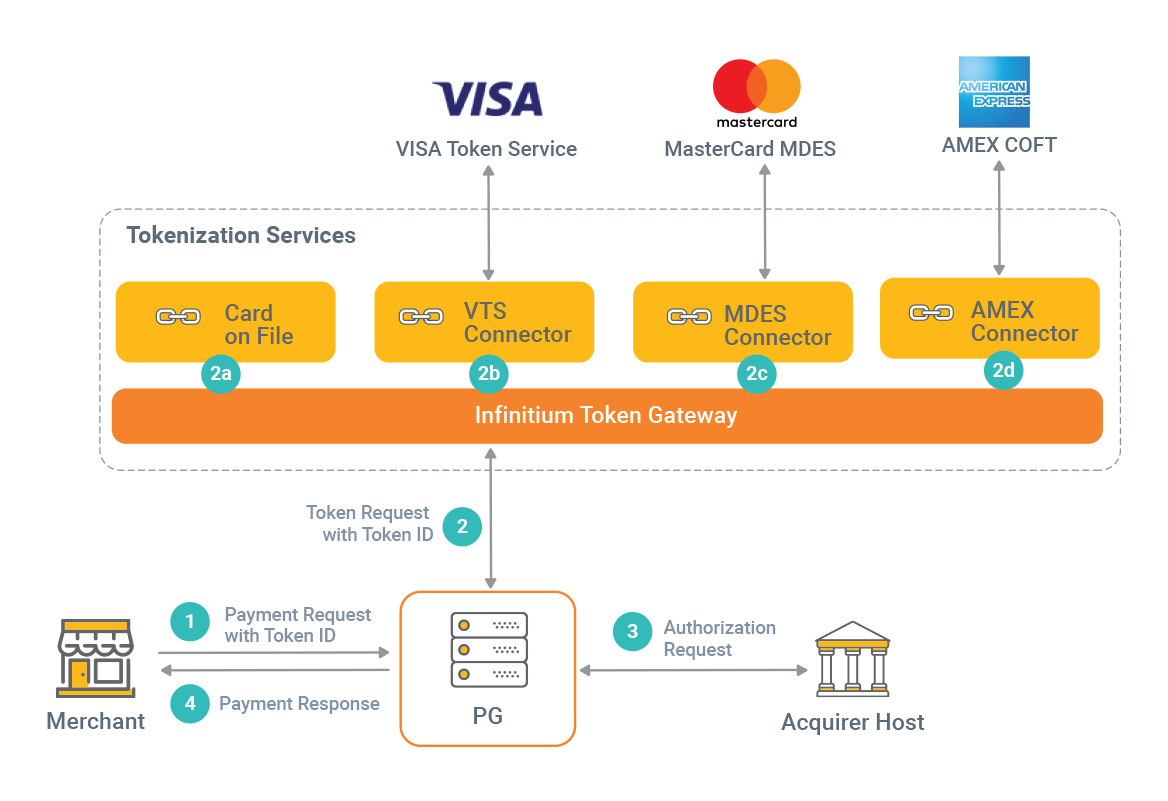

Infinitium’s Token Gateway supports a hybrid tokenisation model to offer the best of both worlds in tokenised payments. Infinitium supports Scheme Tokenisation Service covering the global card schemes such as Visa, MasterCard and American Express (Amex), as well as Card-on-File (COF) Tokenisation for all other payment acceptance methods.

Infinitium, Certified TR/TSP

with Global Card Schemes for Tokenisation

Infinitium is officially appointed as a Token Requester-Token Gateway Provider (TR/TSP) by global card schemes – Visa, MasterCard and American Express (Amex) – to support scheme tokenisation with their respective digital payment platforms, namely Visa Token Gateway (VTS, MasterCard Digital Enablement Service (MDES) and American Express Card-on-File Tokenization (Amex COFT).

As an accredited token gateway provider, Infinitium can connect to the scheme’s Token Vault and help Token Requestors, typically Merchants and Acquirers, to develop consumer digital payment solutions in the form of Tokenised Payment. Infinitium offers Token Gateway as part of payment processing services and is fully integrated with the payment processing flow, allowing Merchants and Acquirers to focus on growing their business while partnering them to help keep their operations and processes in compliance.