Corporate Payment Requirements

Notwithstanding the multitudinous payment methods covering a wide range of pricing, convenience and risks,

the core requirements of a corporate payment remain the same.

Assurance of payment

The recipient is assured of receiving the payment, even if it is not real-time

Security of payment

The payer (buyer) and the recipient (seller) know that the payment is securely effected to the intended recipient

Clarity of payment

The payer and the recipient have real-time visibility of the payment status; and especially important, the recipient is provided with enriched payment details to facilitate reconciliation.

Advanced Core Engine (ACE): Robust as a Bank, Nimble as a FinTech

Infinitium’s ACE is designed with the goal of simplifying and transforming B2B payments and receivables. Free from the restrictions of legacy banking systems, this solution runs on established scheme network rails to deliver the end-to-end process of corporate payments.

Through B2B ACE, the three core payment requirements of corporates are addressed in a simple and cost-effective manner, without the need for system changes. Further, our solution brings enhanced efficiencies and better user experiences to the payments process.

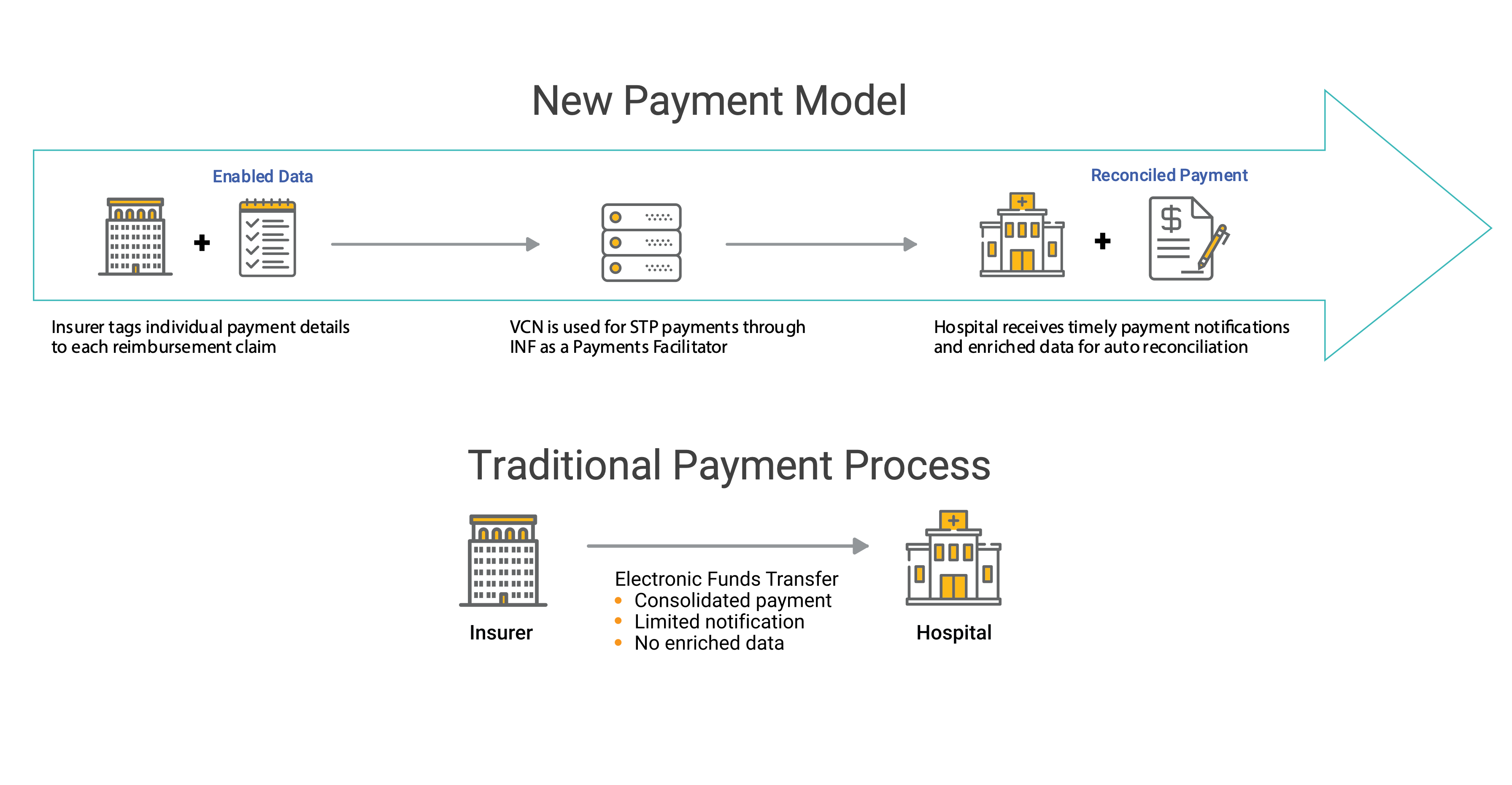

Embedding Straight-Through Processing (STP) into Existing Business Processes

B2B ACE makes and accepts payments in a STP manner. The STP mechanism allows for secure transactions to be made without the need for any form of manual interventions. This reduces chances of fraud and improves efficiency.

Increasing Efficiency with Automated Reconciliation

B2B ACE enables quick reconciliation by having each payment transaction tagged with enriched data. This allows corporates to gain greater visibility and clarity over high-volume payments, which is especially beneficial as each transaction is matched accurately with no manual intervention.

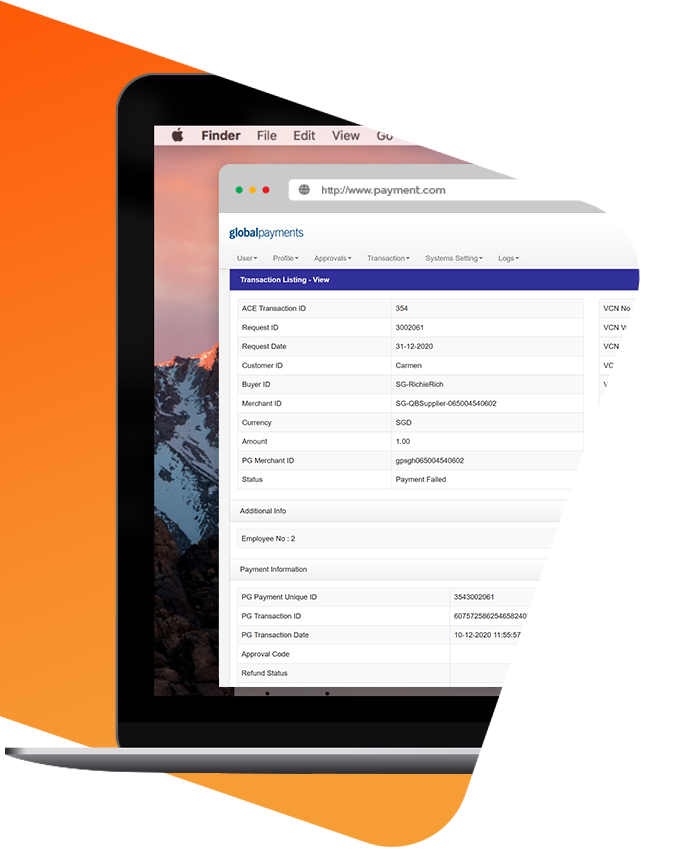

Improving Visibility of Transaction Data in Near Real-Time

B2B ACE brings the capability to view near real-time detailed transaction data via email notifications and portal access. For any corporate, the ability to track its payments and past-due receivables accurately and quickly is of great importance; failing which, cash flow would be adversely affected, especially for SMEs. While streamlining the end-to-end payment processes, B2B ACE also ensures the inclusion of SMEs in benefiting from the larger payment ecosystem.

Case Study: Logistics Company Disbursements to Truckers

A logistics company wishes to provide a better payment experience to its independent truckers. Infinitium B2B ACE leverages on virtual card capabilities to deliver timely payment notification and enriched payment information to the truckers. This enables the logistics company to build trust with the truckers and become stronger business partners.